Things Are Tough All Over (Or at Least for the Richest 5%)

by Craig Jennings, 4/14/2009

Over at the Cato Institute blog, Cato @ Liberty, Chris Edwards tells us that a new CBO report shows that the federal tax code is progressive. CBO data indicate that the highest quintile of income earners paid the highest effective federal tax rate (25.8%), and as one moves down the quintiles, effective federal income tax rates decline.

Edwards uses these facts to take a swipe at President Obama's plan to roll back the Bush tax cuts for those earning more than $250,000.

President Obama doesn’t think that the 25.8% rate paid by the top quintile is progressive enough, so he plans to penalize that group with an income tax rate hike.

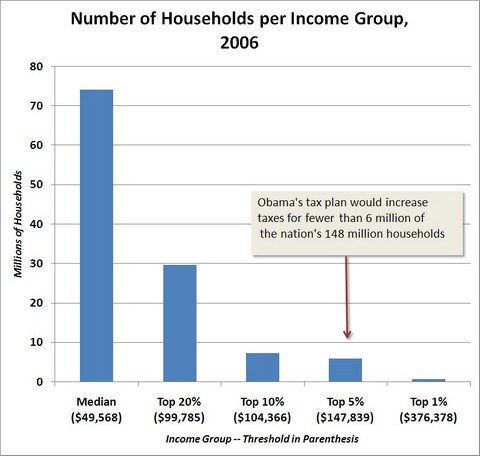

Not true. In 2006, the fifth quintile -- the 20 percent of the population with the highest incomes -- began at $99,785. If you made $178,949 you were in the top 5 percent of income earners. In fact, the Census Bureau data, which I am quoting here, do not indicate in which percentile someone who earned $250,000 was. However, a pair of academic researchers indicate that the top 1 percent of income earners in 2006 were those households that earned at least $376,378.

So, rather than "penalizing" the top 29,672,200 taxpaying households, or the top quintile, as Edwards asserts, Obama's tax plan would increase taxes on significantly fewer than 7,418,050 households (probably closer to 2 million).