Never Mind the Facts, What the Economy Needs Are Tax Breaks

by Craig Jennings, 4/1/2009

The House and Senate are debating this week and will most likely vote on their respective budget resolutions. As per tradition, the minority party will offer their own budget resolution for a vote. In a Wall Street Journal Op-Ed today, Ranking House Budge Committee Member Paul Ryan (R-WI) introduces America to their spending blueprint, otherwise known as "The Republican Budget: Now with NumbersTM."

Ryan serves up the rhetoric typical of Republican budget making:

Our plan halts the borrow-and-spend philosophy that brought about today's economic problems, and puts a stop to heaping ever-growing debt on future generations -- and it does so by controlling spending, not by raising taxes.

But there's also this common trope about taxes and small businesses:

[T]he president's plan [includes]...a $1.5 trillion tax increase to further shackle the small businesses and investors we rely on to create jobs...

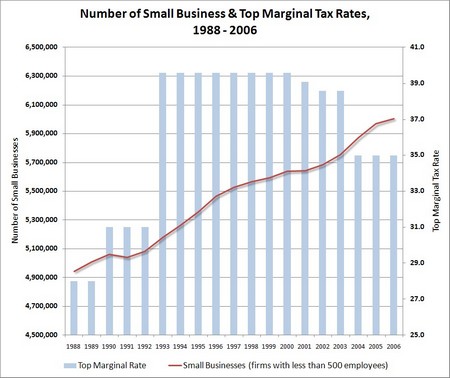

A look at the record, however, exposes this as little more than wishful thinking on the part of policy makers looking for any reason to justify a tax cut.

You'll notice that under the crushing weight of a top marginal tax bracket of 39.6%, the number of small businesses -- businesses with fewer than 500 employees -- grew at an economy-stifling pace of 8.8 percent. And then when President Bush unbound those small businesses and pumped the life-saving blood of a 35% top marginal tax bracket in their veins, their numbers increased 4.4%. Clearly, higher taxes are the bane of economic growth.