What Happens When We Tax the "Job Creators"

by Craig Jennings, 9/22/2011

I'm not sure what a "job creator" is, but for Republicans leveling criticism at Obama's recent deficit reduction proposal, a "job creator" is simply a high-income earner. They argue that because many small business owners file their taxes as individuals, if individual income tax rates on individuals are increased, it will reduce the investment capital available for small businesses to hire more people. Here's House Budget Committee Chair Paul Ryan (R-WI) explaining the logic.

The other thing, in the tax side is permanent tax increases on job creators doesn't work to grow the economy. It's actually fueling the uncertainty that is hurting job growth right now. And don't forget the fact that most small businesses file taxes as individuals. So, when you are raising these top tax rates, you're raising taxes on these job creators where more than half of Americans get their jobs from in this country.

In fact,only about 2 percent of small business owners actually see enough profit to have incomes in the top two income brackets. Let's examine Ryan's logic. If I am a small businessman who is able to take home $300,000 in profit/income to support my family (a very small percentage of small business owners, by the way), I will find myself in the 33% tax bracket. Increase my taxes by 3% and I will pay about $5000 more a year. Does Ryan really think that this will have an effect on my hiring decisions? I will hire or not depending on whether there is consumer demand for my product or services. Now let's look at the relationship between tax rates at the very top of the income pyramid and job growth.

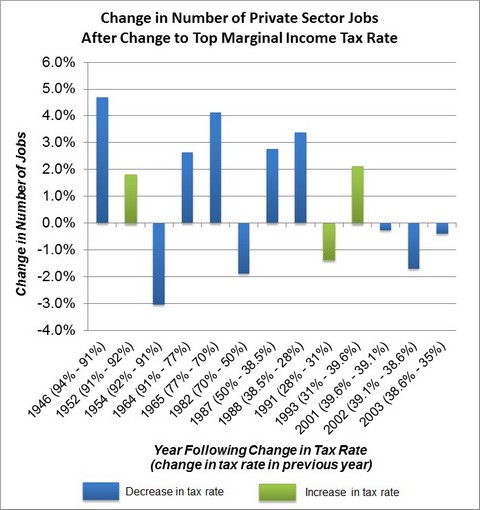

Since 1945, the tax rate has been changed 13 times. If the Republicans were correct, we would expect to see employment rise in the year following any decrease in the tax rate (blue bars). As the graph above shows, there is no such relationship.

In other words, the decision to hire or fire really isn't based on whether the top marginal income tax rate goes up or down. The graphic below drives this point home: changes in the job market are not associated with changes in the top marginal rate. Given the available evidence, policy makers concerned about the deficit should have little concern about the economic effects of increasing revenue by asking the well off to pitch in a little more.