Spending Caps: The House Budget Resolution by Another Name

by Craig Jennings, 4/25/2011

As the date approaches when the Treasury will meet the debt ceiling, the demands of the hostage takers House and Senate conservatives who are playing hard-to-get for their vote to up the ceiling are becoming known. And naturally, rather than put forth ideas that would make a serious attempt at reducing the federal budget deficit, these MOCs are demanding budget mechanisms designed to only limit spending. They include things like a balanced budget amendment, a two-thirds vote requirement for tax increases and debt limit increases, and spending caps.

The balanced budget amendments that have been offered contain some form of spending caps, and a bill (S. 245) introduced by Sen. Bob Corker (R-TN) in February known as the Commitment to American Prosperity Act of 2011 (or "CAP," get it?) is a stand-alone measure that would limit federal spending to 20.6 percent of the economy, or "GDP." Also known as Corker-McCaskill, the CAP Act would initially limit spending to 25 of GDP in 2013 and phase in over a number of years a lower and lower limit on federal spending until 2023 when it would reach 20.6 percent.

Although there is some intuitive appeal to limiting spending to historical levels, a close examination of the proposal reveals that it would succeed only in making deep cuts in Social Security and Medicare and erode an already dwindling tax base. In other words, spending caps like the one called for in Corker-McCaskill are a backdoor to the fiscal monstrosity know as the House budget resolution (BR).

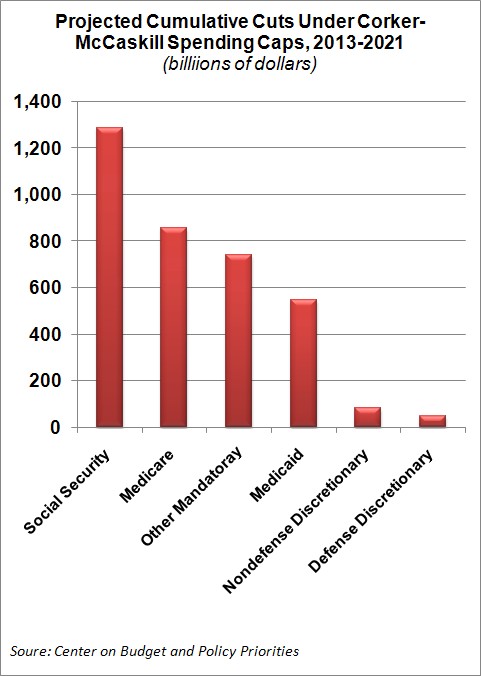

The Center on Budget and Policy Priorities has done the math on Corker-McCaskill, and the results are apalling.

To comply with the cap, therefore, Congress would effectively have to eliminate most or all of the expected growth in Medicare, Medicaid, and Social Security that results from [the aging of the population and the growth in health care costs]. That would require imposing cuts of stunning depth in Medicare, Medicaid, and Social Security, with the cuts growing steadily deeper over time.

...

If the cuts came entirely through the sequester, Medicare, Medicaid, Social Security, and other mandatory programs all would be cut 19 percent in 2021....In dollar terms, mandatory programs would be cut by nearly $630 billion in 2021. Social Security would be cut by $237 billion, Medicare by $161 billion, and Medicaid by $105 billion. As noted earlier, from 2013 through 2021, the cumulative cuts would total about $1.3 trillion in Social Security, $856 billion in Medicare, and $547 billion in Medicaid.

Keep in mind that over this same time period, the House BR would cut Medicaid by $771 billion, Medicare by $30 billion (but much much more a few years later), and nothing from Social Security. Excepting the massive cuts to Social Security, the Corker-McCaskill program looks stirringly similar to the House BR. But Congress always finds a way to make sure campaign contributors and favored constituents see some largesse, and there's no reason to believe that a spending cap will stymie them.

The spending caps, as defined in the Corker-McCaskill bill, would also create strong incentives for Congress to create all sorts of new and exotic loopholes in the tax code (AKA tax expenditures). Currently, the federal government spends over $1 trillion through the tax code to support health insurance purchases, home ownership, education, retirement saving, business equipment purchases, contributions to charities, and on and on and on. Because a so-called spending cap would be a limit on cash outlays only and not tax expenditures, members of Congress would enact new deductions and credits to fund their policy priorities.

The existing number and magnitude of current tax expenditures demonstrates that Congress has no shortage of imagination when they don't want their spending to be counted as spending. Corker-McCaskill would create a lot of jobs in the accounting industry, bleed cash from the Treasury, and make spending even less transparent than it already is.