The Economy is not the People

by Craig Jennings, 4/19/2010

In a post questioning the feasibility of "pay[ing] off our debt" by only raising taxes on those earning more that $250,000, the Committee for a Responsible Federal Budget (CRFB) tragically confuses "the economy" with "people." The answer to their query, by the way, "can Only Taxing Income Over $250,000 Pay Off Our Debt?" turns out to be "yes, yes we can pay off our debt."

The Committee, however, notes that the marginal rates that would have to be imposed on the two highest income brackets would have to be 85.7 percent and 90.9 percent, respectively to accomplish this goal. Unfortunately, these tax rates are the "wrong" answer, and the Committee concludes that "we can't solve our fiscal problems solely on the backs of high earners." The reason, the Committee notes, is that at rates this high, income earners will find ways to hide income and/or simply work less.

CFRB asserts that "as the government lays claim to higher percentages of earnings, incentives to work, invest, and innovate are decreased and the whole economy suffers." Two things deserve some scrutiny here:

First, "the economy" is not the same thing as the people who live with it. Things that positively or negatively affect the economy may or may not positively or negatively impact the vast majority of citizens living within it. One need only look at the pay of the CEOs and other employees of the banks whose reckless and avaricious actions forced massive bailouts by the American taxpayer of those banks. Consider also that from 1972 to today, workers have become 5 times more productive buthave seen their pay increase about 12 percent in that same period. And from 1992 to 2007, the 400 income earners have seen their pay increase 409 percent while the median family income increased 13 percent. So it doesn't appear that economic growth benefits everyone equally or even a little bit close to proportional.

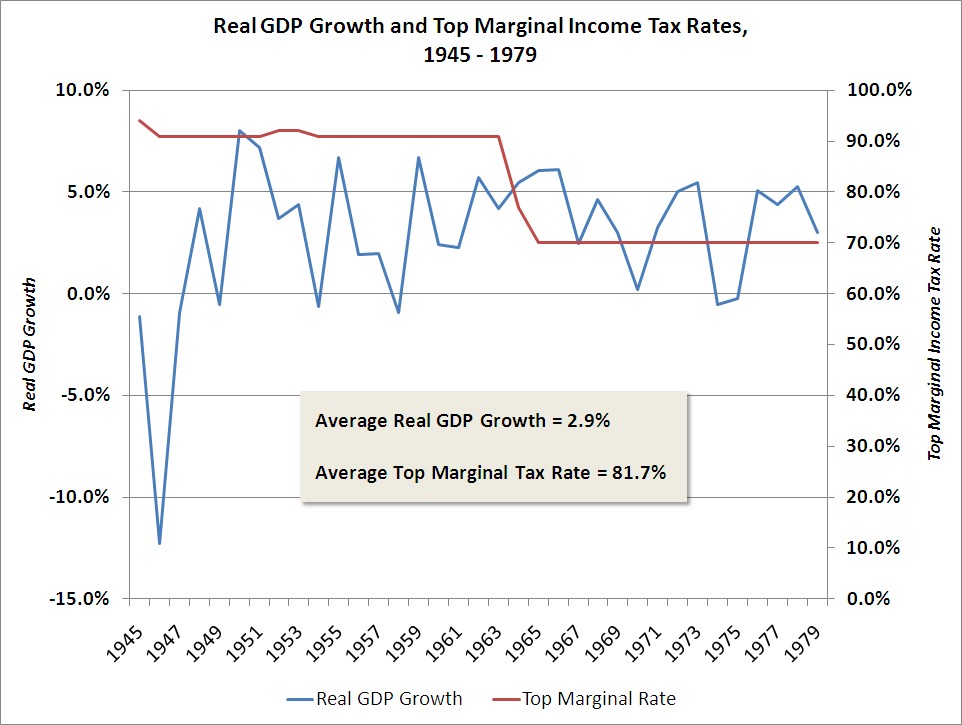

Second, the rates suggested in the CRFB analysis are the same rates that were on the books during that golden age of middle class growth from 1945 to the the late 70s, when the marginal rate for those earning more averaged more than 80% and were as high as 94.0 percent. Clearly, there is something else besides a correlation between top marginal income tax rates and economic growth. In fact, there doesn't appear to be any relationship between the two whatsoever.